The Half-cent Sales Tax for Transportation funds improvements that make travel safer, healthier, and easier for all. Photo by Sergio Ruiz

The Sales Tax funded the Salesforce Transit Center, San Francisco's new regional transit hub, featuring service for five bus systems, a rooftop public park, and more. It accommodates more than 100,000 passengers each weekday, and up to 45 million people per year. Photo by Sergio Ruiz

The Sales Tax is funding the Caltrain Modernization program, which will deliver faster, more reliable service and curtail long-term environmental impacts by reducing noice, improving regional air quality, and lowering greenhouse gas emissions.

The Sales Tax supported the redevelopment of Balboa Park Upper Yard. This transit-oriented development now includes 131 units of affordable housing, pedestrian safety improvements, and a public plaza in proximity to Balboa Park BART Station. Tom Fitzgerald / Courtesy: Mithun

The Sales Tax funds the purchase new SFMTA transit vehicles, including light rail vehicles, hybrid electric and battery electric motor coaches, electric trolleybuses, and paratransit vans. Photo by SFMTA Photography Department

The Sales Tax supports SFMTA's innovative paratransit program, which provides public transportation services to people with disabilities who are unable to use Muni's regular fixed-route service.

The Sales Tax funds Safe Routes to School, which delivers infrastructure improvements and non-infrastructure programs to help make the journey to school safer. Photo by SFMTA Photography Department

The Sales Tax funds the construction of curb ramps each year to make sidwalks and streets throughout San Francisco safer for people with disabilities. Photo by SFMTA Photography Department

The Sales Tax funds planting and establishment of hundreds of trees along public streets throughout San Francisco each year.

The Sales Tax funds the Transportation Authority's Neighborhood Program, which supports neighborhood-scale transportation projects in each supervisorial district. The Upper Market Street Safety Project made sidewalk and bikeway upgrades and more. Photo by Sergio Ruiz

Introduction

The Transportation Authority has administered the half-cent transportation sales tax since the first measure was approved by voters in 1989. The half-cent transportation sales tax generates about $100 million per year and has helped fund transportation projects across the city, including new buses and light rail vehicles, street paving, bike lanes, pedestrian safety improvements, paratransit services for seniors and persons with disabilities, and more.

Revenues from the Half-cent Sales Tax for Transportation are directed towards:

- Neighborhood-level investments such as crosswalks, traffic calming, new and upgraded traffic signals, bicycle lanes, and Safe Routes to School programs

- Citywide improvements like electrifying Muni’s bus fleet, transit signal priority, maintaining buses and trains so they operate safely and reliably, and increasing capacity on both Muni and BART to reduce crowding

- Implementing improvements identified in community-based plans across the city and particularly in Equity Priority Communities

- Major projects like The Portal (formerly known as the Downtown Caltrain Extension), bringing Caltrain to the Salesforce Transit Center

In November 2022, San Francisco voters approved Proposition L, the Sales Tax for Transportation Projects measure that will direct up to $2.6 billion (2020 dollars) in half-cent sales tax funds over 30 years. Prop L came into effect on April 1, 2023, superseding the previous half-cent sales tax, Prop K.

Learn more about the Sales Tax here.

Sales Tax Stories

See how sales tax dollars work for you. Go to Sales Tax Stories to see how people across San Francisco benefit from the city's half-cent sales tax for transportation.

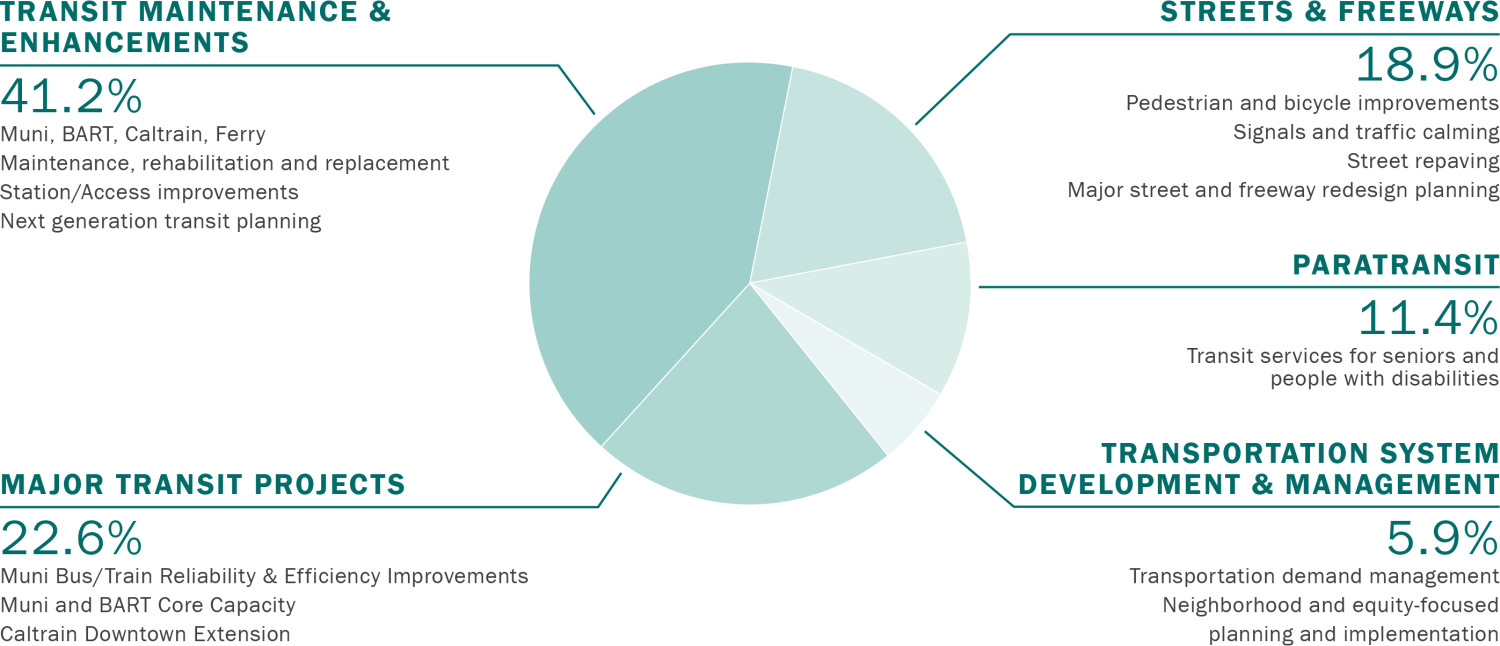

Types of Projects Funded by the Prop L Transportation Sales Tax

Prop L sales tax revenue will be invested in 5 major categories over 30 years.

* Includes both Priority 1 (conservative forecast) and Priority 2 (more optimistic) revenues.

Proposition L Transportation Expenditure Plan Fact Sheet (PDF)

Learn more about the Expenditure Plan.

Learn more about projects funded by the half-cent sales tax.

Contact

Whether you are a San Francisco resident, worker, or visitor, it is likely you have already experienced an improvement supported by half-cent sales tax transportation funding.

In November 2022, San Francisco voters approved Prop L, superseding the previous half-cent sales tax for transportation, Prop K, and approving a new 30-year Expenditure Plan identifying projects and programs to be funded by the sales tax. The Prop L Expenditure Plan prioritizes up to $2.6 billion (in 2020 dollars) and leverages over $20 billion in federal, state, and other local funds to help deliver safer, smoother streets, more reliable transit, continue paratransit services for seniors and persons with disabilities, reduce congestion, improve air quality, and more.

Read more about Proposition L approval.

Information on the Prop K (2003) and Prop B (1989) transportation sales tax measures can be found in the Reports and Documents tab under Additional Resources.

Expenditure Plan

The Prop L Expenditure Plan describes the types of projects that are eligible for funds. It includes a paratransit operations category and twenty-seven programs comprising projects ranging from street resurfacing to new and upgraded traffic signals to pedestrian safety improvements to transit vehicle replacements. The Transportation Authority works with city agencies in five-year cycles to program half-cent sales tax funds to specific projects eligible for funds from the programs.

The Expenditure Plan identifies eligible agencies and establishes limits on sales tax funding for each Prop L program. It also sets expectations for leveraging of sales tax funds with other federal, state, and local dollars to fully fund the Expenditure Plan programs and projects. However, it does not specify how much sales tax revenue any given project would receive by year. The Expenditure Plan requires that the Transportation Authority develop and adopt periodic updates to the Strategic Plan and 5-year project lists to guide the implementation of the program while supporting transparency and accountability.

More information can be found in the Reports and Documents tab under Expenditure Plan.

Prop L Expenditure Plan Summary (PDF)

Full Expenditure Plan (PDF)

Strategic Plan and 5-Year Project Lists

The Prop L Strategic Plan sets policy for administration of the half-cent sales tax program to ensure prudent stewardship of taxpayer funds. It also reconciles the timing of expected sales tax revenues with the schedule for when project sponsors need those revenues, and provides a solid financial basis for the issuance of debt needed to accelerate the delivery of projects and their associated benefits to the public.

Concurrent with updates of the Strategic Plan every five years, the Transportation Authority works closely with eligible agencies to develop lists of projects to be funded from each of the 28 programs. These 5-Year Prioritization Program documents have detailed project information, including scope, schedule, cost, funding information for Prop L funds and all other fund sources, and performance measures.

More information can be found in the Reports and Documents tab under Strategic Plan and 5-Year Prioritization Programs.

Prop L Strategic Plan, April 2025 (PDF)

Making Sure the Sales Tax Is Equitable

Sales taxes have regressive aspects, meaning they pose a greater financial burden on people with lower incomes who spend a higher proportion of their income on day-to-day purchases than do higher-income people. The Transportation Sales Tax includes policies intended to mitigate this regressivity and advance equity, including:

- Facilitating transparency and accountability in governance and administration, including reviewing all funding items with our Community Advisory committee prior to consideration by the 11 members of the San Francisco Board of Supervisors, who sit as the Transportation Authority Board.

- Making a majority of the investments in transit and safety, which disproportionately benefit low-income San Franciscans.

- Engaging the public early, including low-income communities and communities of color, in shaping the new transportation Expenditure Plan.

See our Outreach Findings Report (PDF) for more details on how we engaged with the public about the development of the Prop L Expenditure Plan.

As part of our Racial Equity Action Plan, we are using the Racial Equity Toolkit (created by the Government Alliance on Race & Equity) to operationalize equity throughout all aspects of this process. Our Equity Assessment Report (PDF) is a product of this work, and includes research on transportation disparities and recommendations that helped address those disparities in the Expenditure Plan development process and in its programs and policies.

See a map of San Francisco's Equity Priority Communities here, which includes a diverse cross-section of populations and communities that could be considered disadvantaged or vulnerable now and in the future.

Transportation Expenditure Plan Advisory Committee

The Prop L Expenditure Plan development process received guidance from a Transportation Expenditure Plan Advisory Committee composed of neighborhood, business, advocacy, and community representatives. The committee met regularly over seven months between August 2021 and February 2022. All meetings were open to the public and attendees had the opportunity to provide feedback. Meeting materials can be found here.

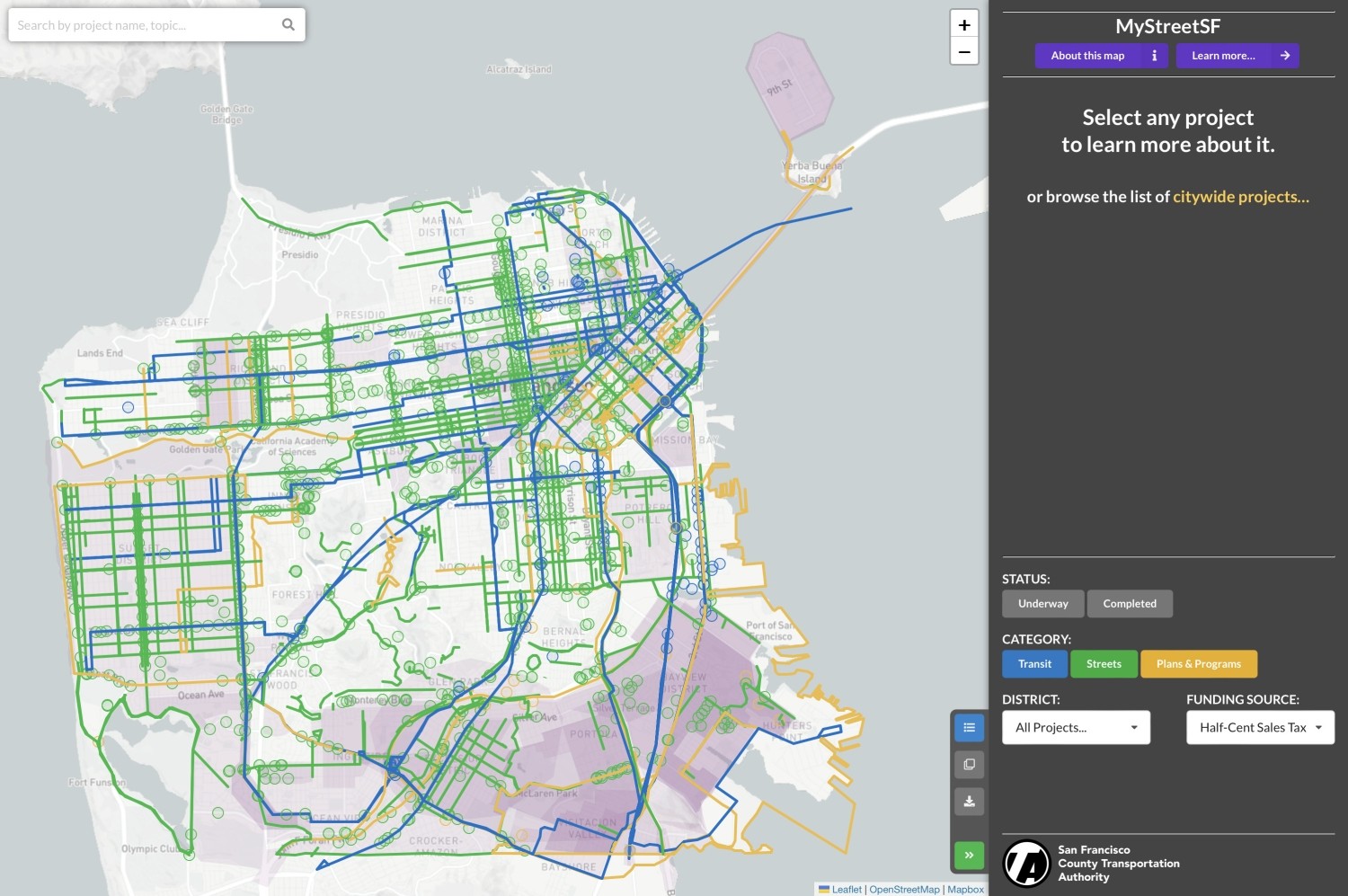

MyStreetSF Interactive Map

Visit MyStreetSF to see a map of projects funded by the half-cent transportation sales tax.

Half-cent Sales Tax Highlights

Transit Maintenance and Enhancements

Caltrain State of Good Repair

Major Transit Projects

Streets and Freeways

Paratransit

Transportation System Development and Management

Sponsor Resources

View Prop L Project Lists (Programming and Allocations) for all 5YPPs (Google Sheet) (Current)

Standard Grant Agreement Sample (PDF) (Updated July 2023)

Portal Guide for Sponsors (PDF), for instructions on submitting quarterly progress reports, amendment requests, and closeout/de-obligation requests. The Portal Guide is also available from the Portal's Help menu.

Allocation Request Forms

We accept Prop L applications through our online grants website, called the Portal. For access to the Portal, contact Amelia Walley, Senior Program Analyst, or email PropL@sfcta.org.

SFCTA Allocation Request Calendar (PDF)

Contact

PropL@sfcta.org

Expenditure Plan

The Prop L Expenditure Plan describes the types of projects that are eligible for funds in 28 programs, establishes limits on sales tax funding by Expenditure Plan program, and sets expectations for leveraging of sales tax funds to fully fund the Expenditure Plan programs. These programs are intended to help implement the long-range vision for the development and improvement of San Francisco's transportation system, as articulated in the San Francisco Transportation Plan.

Prop L Expenditure Plan, 2022 (PDF)

Prop L Expenditure Plan Summary (PDF)

Strategic Plan

The Prop L Expenditure Plan requires that the Transportation Authority adopt a 30-year Strategic Plan, which provides transparency and accountability about how we administer the sales tax and serves as a key financial planning tool for the measure. The Strategic Plan has three main elements - policies, revenues, and expenditures – that establish the amount of Prop L funds available on an annual basis over the 30-year program, with the next 5-year period reflecting the funding needs for projects recommended from the 5-Year Prioritization Programs (5YPPs). The Strategic Plan is how we ensure that projected sales tax revenues are sufficient to cover all program-related expenditures and gives us a sense of how much debt the program can support if agencies seek to advance funds. It also supports project delivery and leveraging of other funds by ensuring that Prop L funds are available when needed.

While the Strategic Plan is the long-range financial planning tool for the program, it is developed in concert with 5YPPs that are used to identify the specific projects to be funded in the next five years. Adoption of these documents is a prerequisite for allocation of funds from Prop L. The first step in developing the Strategic Plan and the 5YPPs is establishing the Strategic Plan Baseline. In addition to providing guidance about program implementation to staff and sponsors through the policies, the Baseline sets the amount of pay-go funding available to each program, by fiscal year, through the end of the Expenditure Plan (2053). We amended the Strategic Plan Baseline to incorporate the programming and cash flow recommendations in the 5-Year Prioritization Programs (5YPPs) as they were approved by the Transportation Authority Board. The Board adopted the final Strategic Plan on April 22, 2025.

Prop L Strategic Plan, April 2025 (PDF)

Prop L Strategic Plan Baseline, June 2023 (PDF)

5-Year Prioritization Programs

The Prop L Expenditure Plan requires development of a 5-Year Prioritization Program (5YPP) for each of the 28 programs to identify the specific projects that will be funded over the next five years in that program. Board adoption of these documents is a prerequisite for allocation of Prop L funds from the relevant programs. The 5YPPs provide a stronger link between project selection and expected project performance, and support on-time, on-budget project delivery. Important elements of the 5YPPs include: establishing performance measures, identifying projects to be funded in the next 5 years, and incorporating public input.

The 5YPPs result in multi-year project lists with associated sales tax programming commitments that support a steady project pipeline, enabling project sponsors to plan ahead, facilitating their ability to secure other funding sources to leverage Prop L and fully fund projects and to line up staff resources to deliver projects. The 5-year look ahead also enables coordination between projects. When a project is ready to advance, the project sponsor can request allocation of funds from the Board based on the programming commitment in the relevant 5YPP.

The 5YPPs also provide transparency about how Prop L projects are prioritized. We work in close collaboration with project sponsors eligible for Prop L funds from a particular program, as well as any other interested agencies, to develop each 5YPP. Input from the Board, sponsors, and the public informs the 5YPP process.

The current 5YPPs cover the period of July 2023 through June 2028.

2023 5YPPs

Prop L 2023 5YPP Documents

Prop L Project Lists (Programming and Allocations) (Google Sheet)

Additional Resources

Prop L

5YPP Town Hall Presentation, June 2023

Prop L Implementation Approach Presentation, January 2023 (PDF)

2022 Sales Tax Expenditure Plan MEMO, March 2022 (PDF)

Outreach Summary for the New Sales Tax Expenditure Plan, February 2022 (PDF)

Equity Assessment for a New Sales Tax Expenditure Plan, September 2021 (PDF)

Equity Assessment: Findings & Recommendations Presentation, September 2021 (PDF)

Prop K

Prop K Expenditure Plan, 2003 (PDF)

Prop K Expenditure Plan Summary (PDF)

Prop K 2019 5YPP Documents

Prop K Project Lists for all 5YPPs (PDF)

Prop K 2021 Strategic Plan (PDF)

Prop K 2021 Strategic Plan, Enclosure (PDF)

Prop K 2019 Strategic Plan (PDF)

Prop K 2019 Strategic Plan Policies (PDF)

Prop K 2014 Strategic Plan (PDF)

Prop K 2009 Strategic Plan (PDF)

Prop K 2005 Strategic Plan (PDF)

Prop B

Prop B Expenditure Plan, 1989 (PDF)

Request a Document

Looking for something else? Request a document.