Photo: Sergio Ruiz

Introduction

The Proposition D Traffic Congestion Mitigation Tax was passed by San Francisco voters in November 2019. The measure, also referred to as the Transportation Network Company Tax, is a surcharge on commercial ride-hail trips that originate in San Francisco, for the portion of the trip within the city. The TNC Tax program intends to deliver improvements to transit reliability and safety on San Francisco’s roadways, mitigating the effects of increased congestion due to TNC vehicles.

Beginning January 1, 2020, a 1.5% tax is charged on shared rides. Through 2024, single occupant trips were taxed at 3.25%, with electric vehicle trips receiving a discount of 1.5%. Since January 2025, a 1.5% tax is maintained on shared rides and 3.25% is charged on all other rides.

The measure also takes into account rides provided by autonomous vehicles which are taxed in this same manner and rides provided by private transit companies if a company enters the market. The tax is in effect until November 2045.

After a 2% set aside for administration by the City and County of San Francisco, 50% of the revenues are directed to the San Francisco Municipal Transportation Agency for transit operations and improvements, and 50% comes to the Transportation Authority for safety improvements.

Eligible Transportation Improvements

The Transportation Authority can fund capital improvements that promote safety. Projects may include:

- Pedestrian safety

- Bicycle safety

- Traffic calming

- Traffic signal upgrades and re-timing

Contact

funding@sfcta.org

Since 2020, the Transportation Authority has allocated $23.6 million in TNC Tax funds to SFMTA’s Vision Zero Quick-Build Program and $11.2 million in TNC Tax funds to SFMTA’s Application-Based Residential Traffic Calming Program.

The TNC Tax policies provide guidance to both Transportation Authority staff and project sponsors on the various aspects of managing the TNC Tax program. The policies address the allocation and administration of funds and clarify the Transportation Authority's expectations of sponsors to deliver their projects.

Current Programming

The current TNC Tax Program Policies, adopted July 22, 2025.

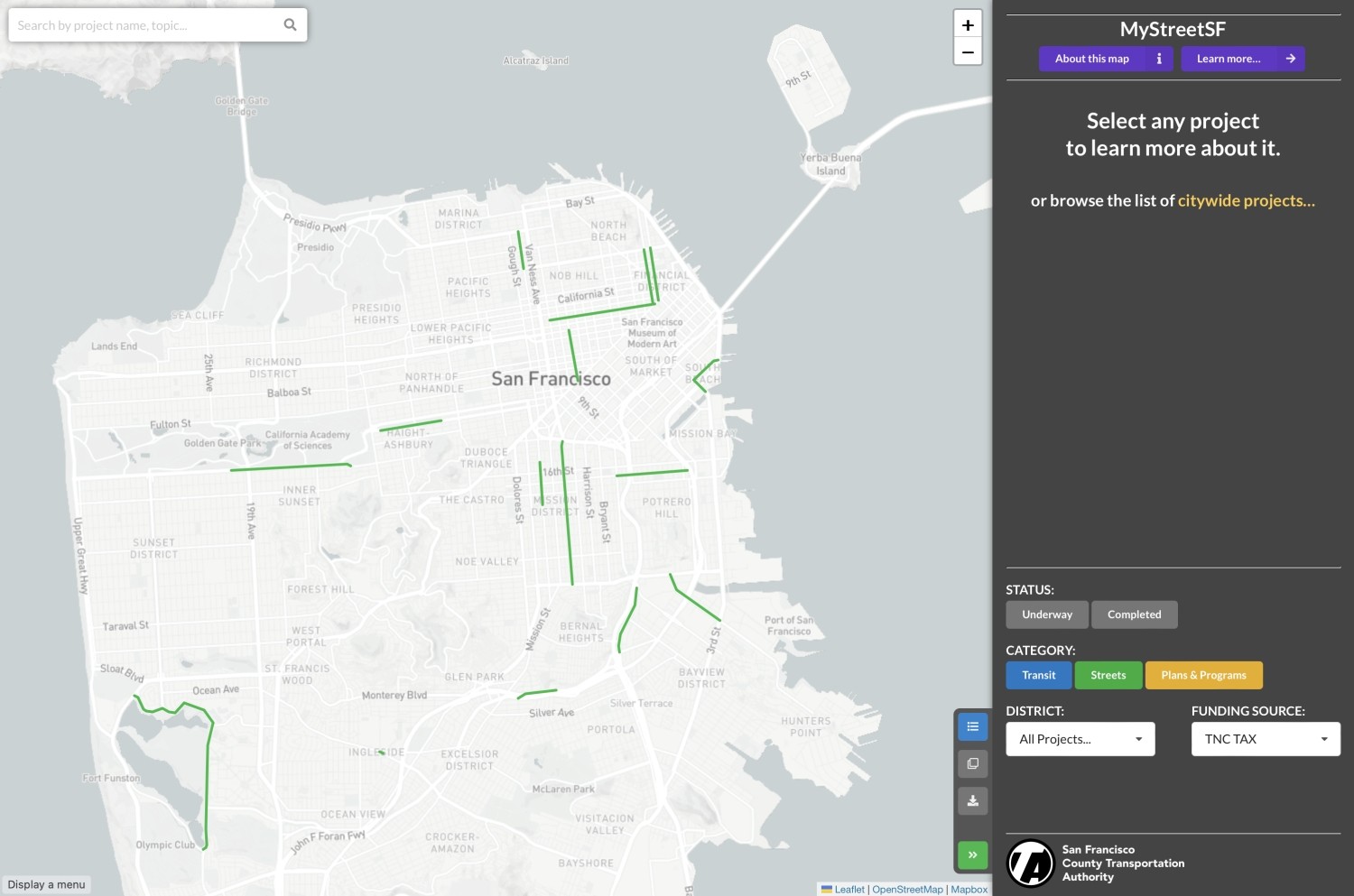

MyStreetSF Interactive Map

Visit MyStreetSF to see a map of projects funded by the TNC Tax.

TNC Tax Project Summary

As of July 2025, the Transportation Authority has allocated a total of $34.8 million in TNC Tax funds as follows:

Project | TNC Tax Funds Allocated |

|---|---|

| Vision Zero Quick-Build | $23,636,426 |

| Application-Based Residential Traffic Calming | $11,157,505 |

| Grand Total | $34,793,931 |

Vision Zero Quick-Build Program

The SFMTA’s Vision Zero Quick-Build Program expedites the delivery of pedestrian safety, bicycle safety, and traffic calming improvements citywide. Quick-build projects are comprised of reversible or adjustable traffic control, such as roadway and curb paint, signs, traffic signal timing updates, traffic lane reconfigurations, and parking and loading adjustments. Safety improvements include protected bikeways, boarding islands, painted safety zones, curb ramps, loading zones, and more.

See SFMTA’s Vision Zero Quick-Build Program page for more information.

Application-Based Residential Traffic Calming Program

The Application-Based Residential Traffic Calming Program enables SFMTA to evaluate application-based residential traffic calming requests and to plan, design, and construct traffic calming devices. The project scope includes low-cost traffic calming measures, including speed humps, speed cushions, speed tables and raised crosswalks. The application-based program objectively evaluates requests and only recommends traffic calming where speeding is confirmed through data collection (in addition to other defined criteria).

See SFMTA’s Residential Traffic Calming Program page for more information.

Sponsor Resources

View Project List for TNC Tax (Google Sheet)

Standard Grant Agreement Sample (PDF) (Updated September 22, 2023)

Portal Guide for Sponsors (PDF), for instructions on submitting quarterly progress reports, amendment requests, and closeout/de-obligation requests. The Portal Guide is also available from the Portal's Help menu.

TNC Tax Allocation Request Procedures (PDF)

SFCTA Allocation Request Calendar (PDF)

Contact

funding@sfcta.org

Current Policies

TNC Tax Program Policies (PDF) (Adopted July 22, 2025) and related July 22, 2025 Board Meeting Materials

Previously Adopted Policies:

TNC Tax Program Guidelines (PDF) (Adopted April 25, 2023) and related April 25, 2023 Board Meeting Materials

TNC Tax Program Guidelines (PDF) (Adopted October 27, 2020) and related October 27, 2020 Board Meeting Materials