Photo by SFMTA Photography Department

Transit agencies are facing a potential budget crisis as unprecedented shifts in transit ridership and declining revenues persist years after the start of the COVID-19 pandemic. Muni, BART, and Caltrain are anticipating significant operating budget deficits within the next two years due to the COVID-19 pandemic’s lasting impacts on transit ridership and revenues. Federal pandemic relief funds have allowed the operators to continue to deliver robust transit services over the past three years of the pandemic. However, Muni, BART, and Caltrain are expected to exhaust those relief funds in the next few years, and barring a rapid recovery of local revenues and transit fares, will go over a proverbial “fiscal cliff.”

Operators will need to consider evolving ridership and work-from-home trends as they address how to attract new riders while meeting the needs of transit-dependent riders. In addition, operators will need to determine new sustainable financial models that are less fare dependent to serve a new vision for post-pandemic transit service in the region. New sources of revenue are one part of the equation to support the future of transit and will require a significant coordinated regional effort to meet agencies’ needs.

During the February 28 Transportation Authority Board meeting, staff from the Transportation Authority, BART, SFMTA, and Caltrain presented on the transit fiscal cliff (agenda item 11).

BART, SFMTA, and Caltrain’s projected combined shortfalls range from about $300 million to $600 million per year in the next several years. They are just three of many transit agencies facing a fiscal cliff in the region and state, leading state legislators to hold hearings and form special committees to discuss the issue, including a new Senate Select Committee on Bay Area Public Transit. On Monday, February 27 a Joint Assembly/Senate Transportation Committee hearing covered the impending fiscal cliff, and a Senate Transportation budget subcommittee will be discussing transit funding in the state budget this Thursday, March 9.

San Francisco’s economic recovery

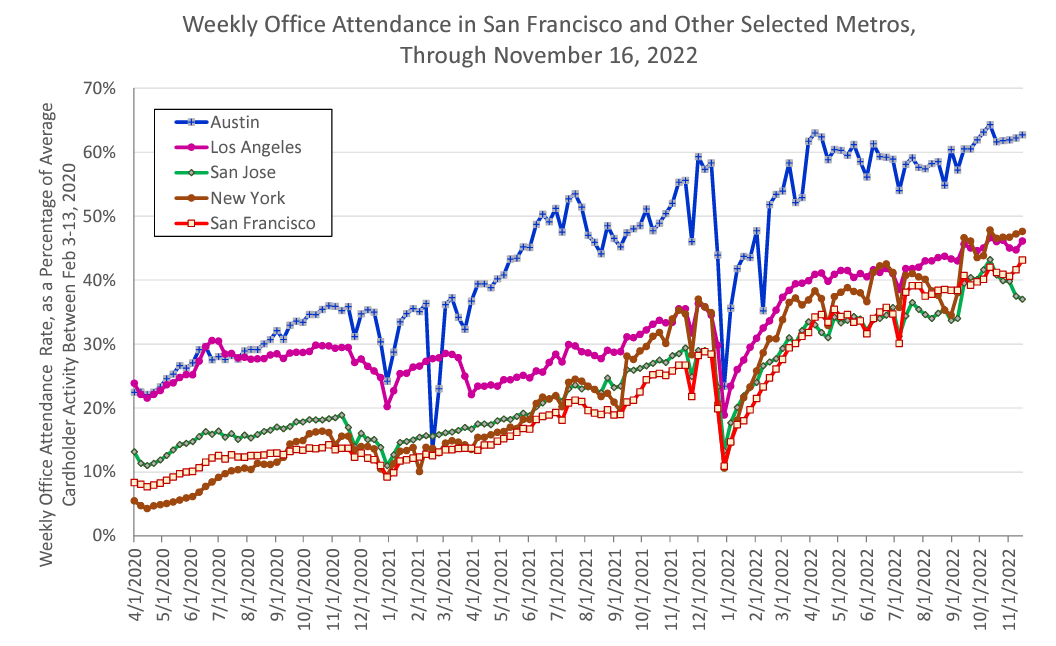

Downtown San Francisco was among the hardest hit by the pandemic and has been lagging behind other downtown metropolitan areas across the country. San Francisco’s downtown activity levels are only at 31% of pre-pandemic levels as of November 2022.

Source: Kastle Systems, Office of the Controller, November 2022 (PDF)

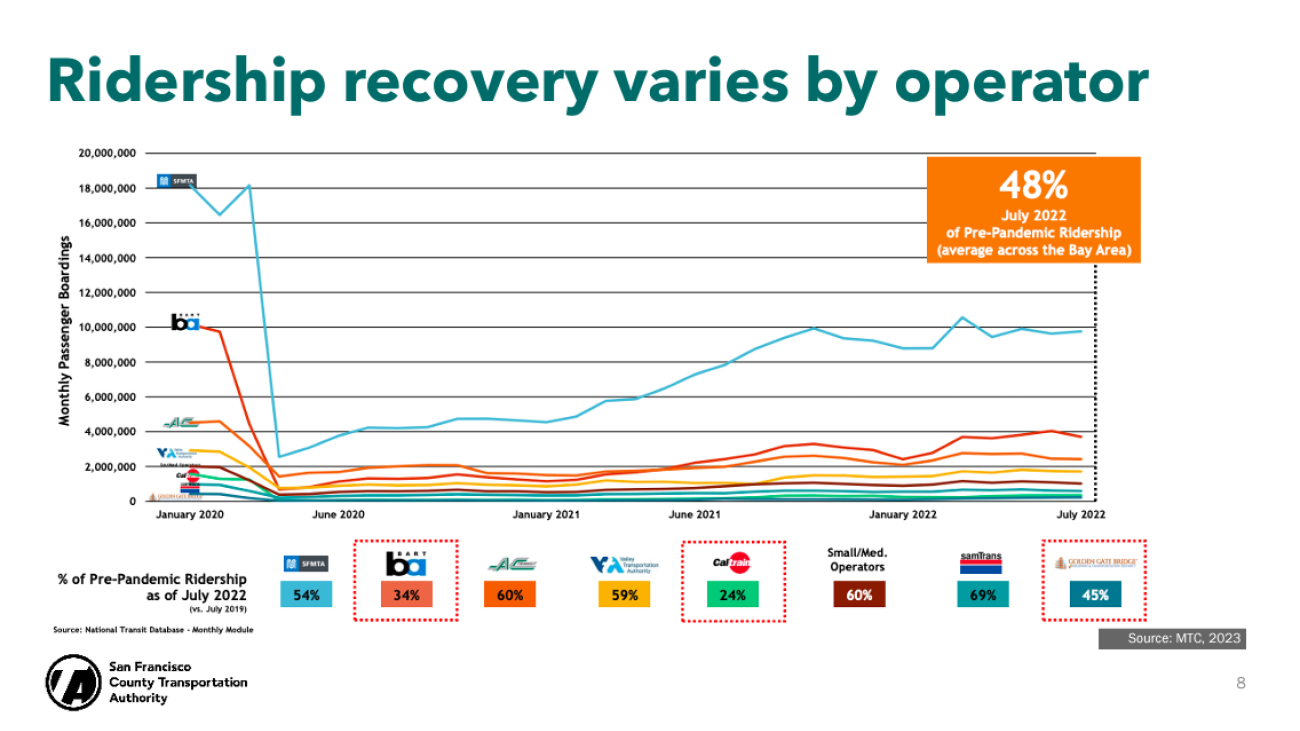

The slow downtown recovery and slow return to transit are contributing to the fiscal cliff facing our city’s transit operators. Across the region, transit ridership is still not at the levels it was at pre-pandemic and remains at only 55% of pre-pandemic levels. However, there is wide variation across the region’s transit agencies, with those like BART and Caltrain that serve primarily commute trips seeing lower ridership numbers with new work-from-home trends.

Source: MTC, 2023

Many who rely on public transit are transit dependent and from low-income communities. Others are choosing not to take public transit for other reasons, such as the delay in restoring service or safety and security concerns. Because of this trend, traffic congestion on roads and bridges has rebounded much more rapidly than transit ridership and is near or back at pre-pandemic levels in many locations.

What does the fiscal cliff look like?

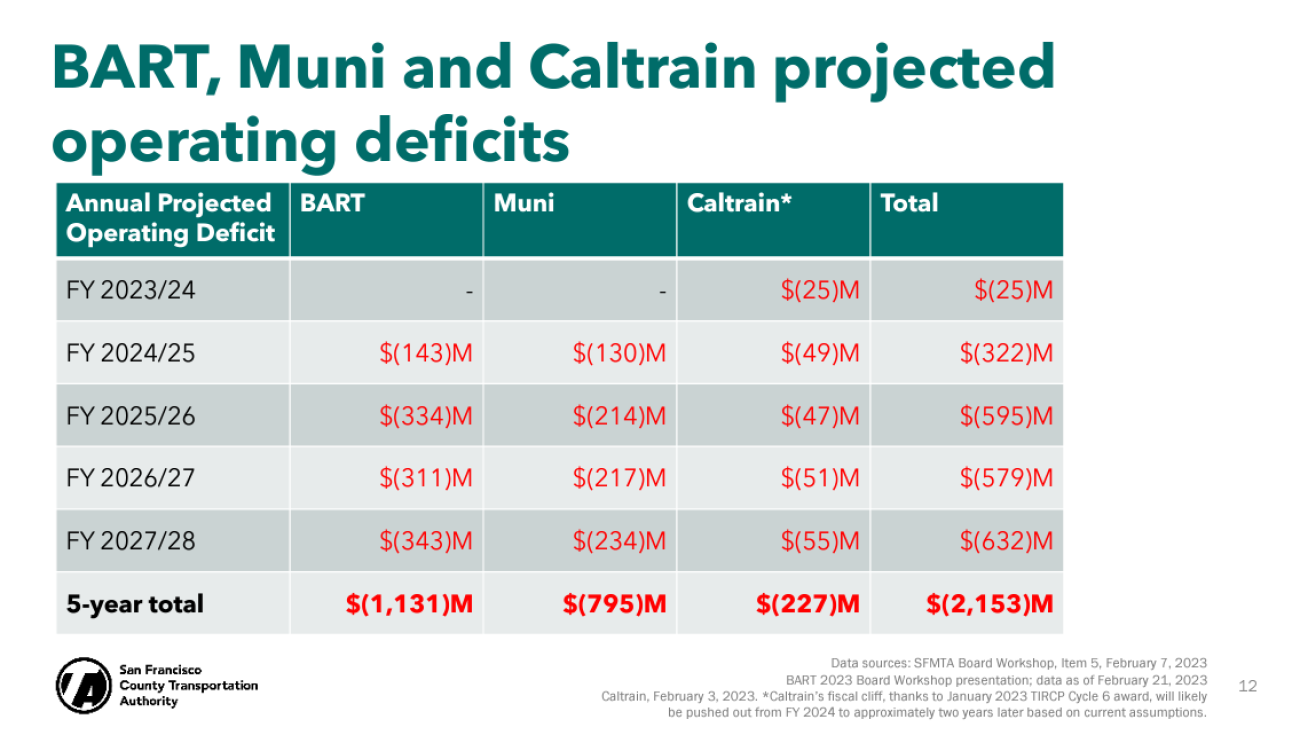

BART, SFMTA, and Caltrain are each facing significant annual operating deficits beginning in the next one or two years, and without major increases in ridership and/or new revenue sources, will have to make difficult choices about how to balance their budgets.

Each agency relies on a unique mix of fund sources for their operating budgets, and some of the largest sources (namely transit fare revenues) have been negatively impacted by low transit ridership and other sources (e.g. parking garages and meters) by reduced commute travel due to increased work-from-home. The table below shows that the cumulative effect is about $2 billion in operating shortfalls over the next five years for these three agencies.

Barring significant new revenues or a rapid reversal of these major societal travel trends, the transit agencies will need to make hard choices that could potentially include cutting service, delaying crucial capital maintenance, and laying off staff, all of which would degrade the quality of transit service for San Francisco residents, commuters and visitors - and present significant challenges for transit-dependent people.

See BART, SFMTA, and Caltrain’s presentations, pages 15-45 (PDF)

These slides show the project operating deficits for BART, Muni, and Caltrain as federal relief funds that have enabled them to sustain service during the pandemic are depleted.

What are the implications of a fiscal cliff?

Robust public transit is essential to meeting San Francisco’s local equity, economic vitality, and climate goals. Further, with well over half of the region’s trips starting and/or ending in San Francisco, the region’s ability to meet its climate and other goals is also dependent on a healthy public transit system serving San Francisco.

More transit trips by low-income riders begin in San Francisco than anywhere else in the region, and low-income riders are disproportionately transit-dependent. Transit service cuts would create gaps in access to jobs, schools, and services for our most disadvantaged populations and create a greater financial burden for those who shift to driving. Reduced transit service would be a step backward for climate goals - people with the option to shift to driving would do so, adding to the already 47% of the city’s greenhouse gas emissions that come from transportation and to the traffic congestion that has returned to major roads and bridges. Downtown’s economic recovery would further be hindered with fewer people able to easily access shopping, restaurants, hotels, and other destinations.

How do we plan for a sustainable financial model?

While travel patterns are still evolving, we know that we can no longer rely so heavily on ridership-based revenues like fares to fund our transit systems.

In the long term, we need to explore new financial models and will likely need local, regional, and state/federal funding sources. These types of long-term sustainable funding solutions require strong coordination between partners and a broad coalition of stakeholders who can work to support legislative and ballot measure initiatives that will be needed. All of this takes time, and the transit agencies’ fiscal cliffs are looming in the next few years.

Transit agencies, the Metropolitan Transportation Commission, California Transit Association, and other stakeholders are working together to advocate in Sacramento for five-year bridge funding to address near-term budget shortfalls. This two-pronged proposal includes funding by need to transit operators facing fiscal cliffs and funding for transit improvements to retain and attract new riders.

The Transportation Authority will be supporting this short-term strategy while working with the transit operators on long-term solutions to help sustain our robust transit network for the benefit of San Francisco residents, workers, and visitors.

To conclude the hearing, Chair Mandelman recognized that San Franciscans will support the call for strengthening transit if the city is able to make the case to them and reiterated that public transit is essential to achieving our city’s goals. Chair Mandelman expressed that it is incumbent on the Transportation Authority board, Mayor’s Office, and related stakeholders to consider if there is a path to secure more operating dollars for transit agencies that serve San Francisco.